Published on May 4, 2025

There’s something wonderfully ironic about economists. They build their lives around models and forecasts, yet some of the biggest surprises in their lives have nothing to do with data—and everything to do with paperwork.

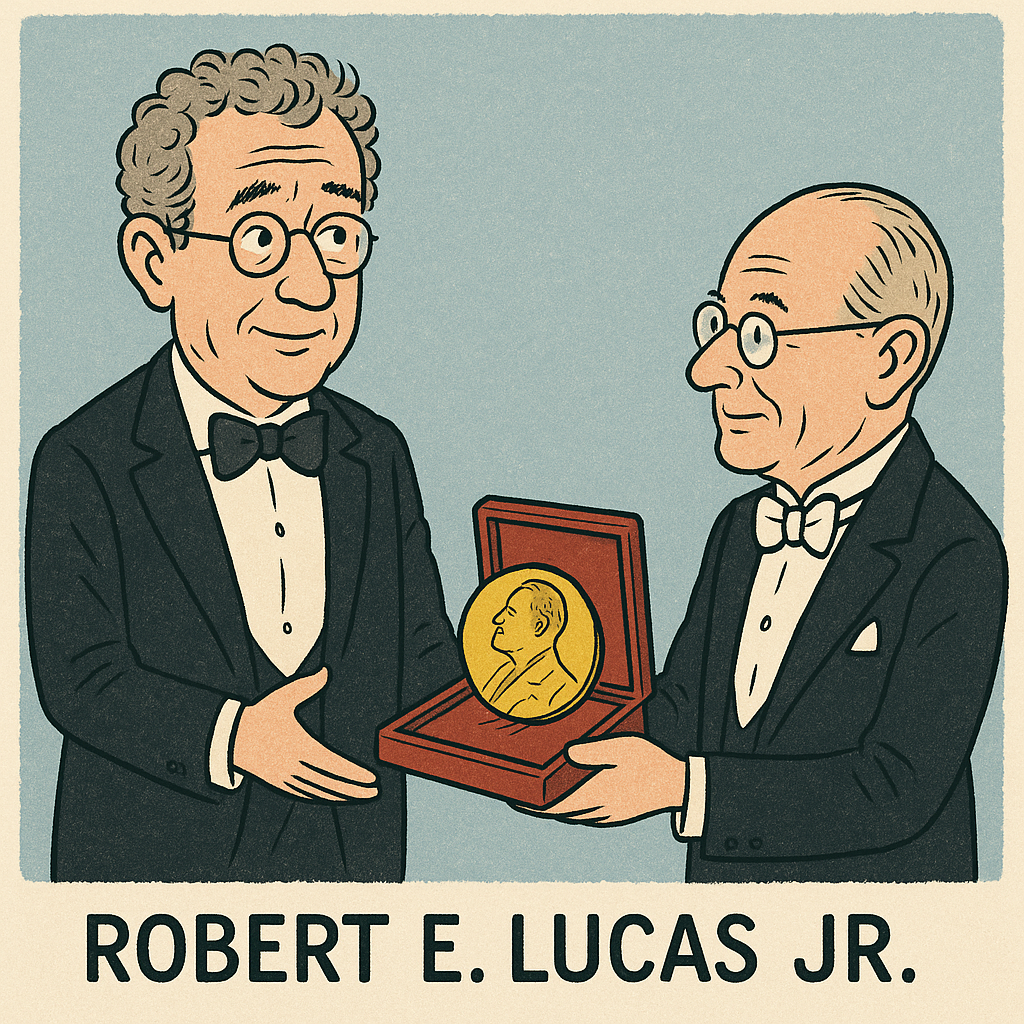

Take Robert Lucas, one of the most influential macroeconomists of the 20th century. If you've ever heard of rational expectations, that’s his doing. He helped turn economic theory on its head by suggesting that people don’t just passively react to government policy—they anticipate it.

Raise interest rates? People start borrowing less before the ink dries.

Stimulus cheques? They’ll save instead of spend, suspecting a tax hike is coming.

In other words, Lucas argued, people are smart. They plan ahead. You can’t outmaneuver them with policy tricks.

Which makes what happened next... kind of perfect.

A Clause with a Clock on It

Back in 1989, Lucas and his wife, Rita Cohen, divorced. As part of their settlement, Rita had one condition written into the agreement—a seemingly harmless line that probably got a smirk from the lawyers before it was signed and filed away.

The clause said:

If Robert wins the Nobel Prize in Economics before October 31, 1995, she gets half the winnings.[1]

No one thought much of it at the time. Lucas was a respected economist, sure. But the Nobel? That was a long shot. And there was a deadline. Five years. Surely, if he hadn’t won it by then, it wasn’t happening.

Now fast-forward to 1995.

The phone rings. It’s Stockholm.

Lucas has just been awarded the Nobel Memorial Prize in Economic Sciences[2].

The prize? $1 million.

Rita’s cut? $500,000, right on time.

According to The New York Times, when someone asked her about it, she replied with the kind of cool confidence you only get from knowing you read the fine print:

“A deal is a deal.”[3]

No press conference. No drama. Just a mic drop in the form of a cheque.

The Punchline of a Lifetime

There’s a quiet genius in this ending. The man who taught the world that people anticipate policy outcomes was outmaneuvered by someone who anticipated his.

Rita didn’t need an economic model or a regression analysis. She just needed a lawyer and a good sense of timing.

It’s not that Lucas got it wrong.

It’s that someone else got it right—and bet on him with a clause that aged better than most 30-year bonds.

And that’s what makes the story so satisfying. Lucas changed the way central banks and policymakers operate. But at home, he fell victim to the very same principle he taught: people adapt, they anticipate, and sometimes… they walk away with half a Nobel Prize.

No hard feelings, dear Robert. Just rational expectations.

Sources

[1]: Cassidy, John. "Annals of Economics: The Real World Economist." The New Yorker, August 6, 2001. (https://www.newyorker.com/magazine/2001/08/06/the-real-world-economist)

[2]: "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1995 – Robert E. Lucas Jr." NobelPrize.org. (https://www.nobelprize.org/prizes/economic-sciences/1995/lucas/biographical/)

[3]: Lowenstein, Roger. "Dividing the Spoils: Lucas’s Rational Expectations Meet Divorce Rationality." The New York Times, October 22, 1995.(https://www.nytimes.com/1995/10/22/business/dividing-the-spoils.html)