Published on May 27, 2025

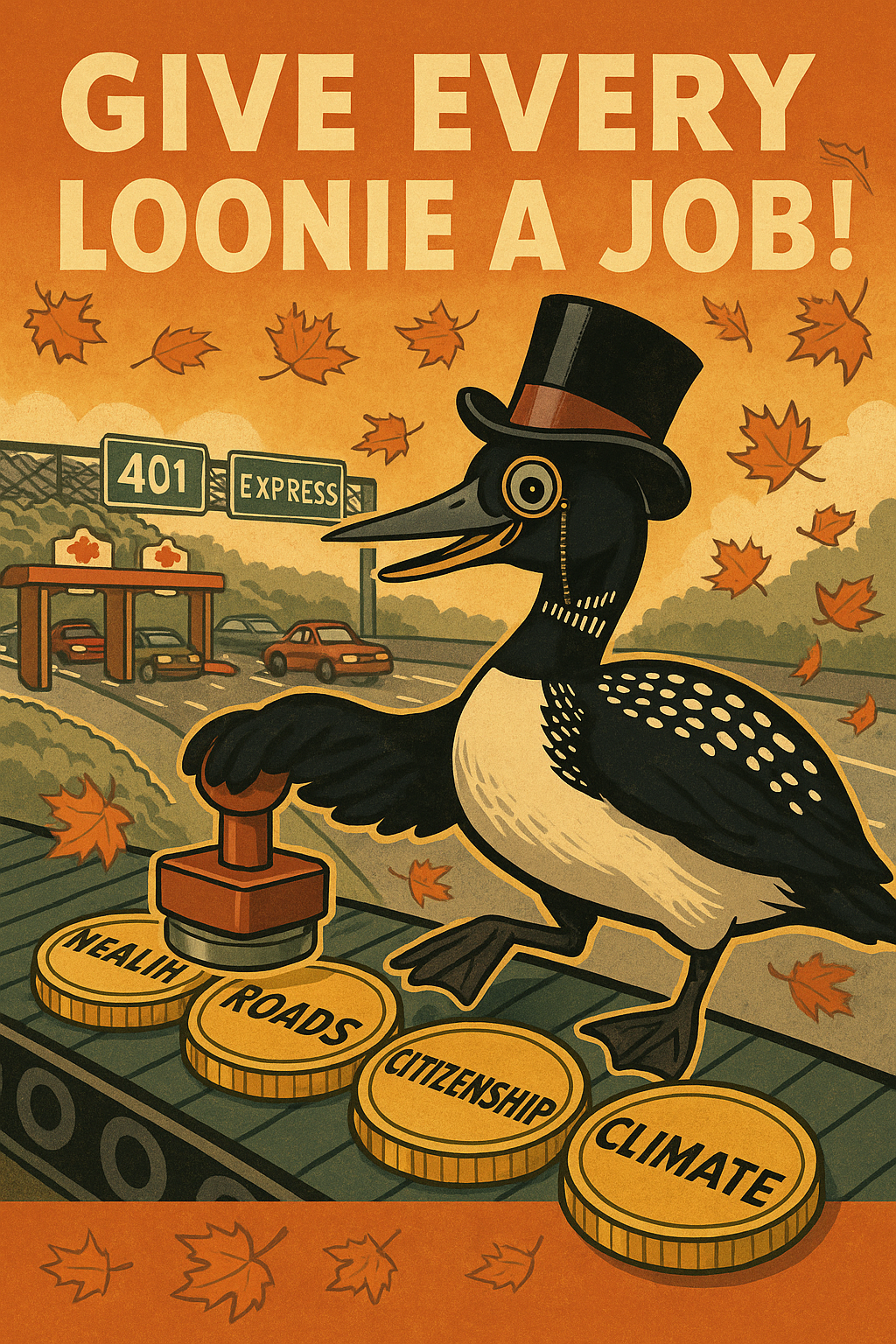

"Label your loonies, and you'll keep more of them." – Sir L.

Picture this: You're a nurse in Hamilton earning $75,000. You get offered overtime, but after taxes and benefit clawbacks, you'd keep maybe $12 from that extra $40 hour. So you stay home, binge Netflix, and the ER waits a little longer. Meanwhile, your snowbird neighbor spends six months in Arizona, pays zero Canadian tax, but still expects the embassy to rescue him when his wallet gets stolen in Phoenix.

This is Canada's tax blob in action. A mystery stew where your money vanishes into general revenue faster than timbits at a hockey tournament. What if we could fix this mess with a simple principle: label every loonie, see where it goes, and watch people actually want to contribute?

The Overtime Trap: A Real Problem

Consider a registered nurse in London, Ontario making $72,000 treating everything from heart attacks to hockey injuries. When flu season hits and the hospital begs for overtime, here's the brutal math:

- Extra shift: $480 (12 hours × $40/hour)

- After federal/provincial tax: $312

- After losing part of her Canada Child Benefit: $290

- After higher daycare fees kick in: $265

That nets $22 per hour for life-saving work. Is it any wonder they'd rather spend Saturday building snowmen with their kids?

This isn't the nurse's fault. It's the blob-tax punishing productivity. We've created a system where working harder literally doesn't pay.

The $115K Middle-Class Mirage

Ottawa loves talking about "middle-class tax relief," but their 2025 cut mainly helps people earning under $114,750 [2]. That sounds generous until you realize what "middle class" actually costs in Canada:

Typical Toronto Family:

- Combined income: $125,000 (teacher + IT worker)

- Mortgage: $3,200/month

- Daycare: $2,400/month

- TTC passes: $280/month

- Groceries: $1,200/month

They're technically "rich" according to Ottawa, but they're eating kraft dinner three nights a week and driving a 2018 Honda Civic with 240,000 kilometers.

Ontario's Accidental Genius

Queen's Park already figured this out by accident, though I doubt they meant to. Their Health Premium feels annoying when you see it on your pay stub, but at least you know that $600 went toward MRI machines, not magic beans.

Last year, it raised about $5 billion [3]. Every taxpayer could point to their hospital and say, "Yeah, I helped pay for that." Compare that to the federal blob, where your income tax could be funding anything from fighter jets to the Governor General's sock drawer.

The Non-Payers Problem

Now for an uncomfortable truth that makes dinner parties awkward: nearly five million Canadians filed tax returns showing zero federal tax [4]. Some tax professionals call this the "pizza problem." That's roughly the population of British Columbia deciding how to spend everyone else's money.

I'm not saying these folks are freeloaders. Many are students, seniors, or struggling families who genuinely need help. But when massive voting blocs have no skin in the game, democracy gets weird. It's like letting people who don't eat pizza vote on toppings for everyone else.

Real Examples That Work

Australia's Medicare Levy: Aussies pay 2% of income for healthcare, period. Rich folks who skip public insurance pay extra [5]. Simple, visible, fair.

London's Congestion Charge: Even after paying £15 daily to drive downtown, Londoners still lost £902 each to traffic in 2023 [6]. But at least they're funding better transit while choosing to sit in traffic.

Our Own Highway 407: Love it or hate it, the 407 ETR pulled in $410 million in Q1 2025 [7] by making drivers pay for premium service. Result? The parallel 401 moves slightly faster.

The 401: Canada's Billion-Dollar Missed Opportunity

Speaking of the 401, sections carry 450,000 vehicles daily [8]. That's like the entire population of London, Ontario commuting past your window every day.

Imagine charging just 5 cents per kilometer for express lanes during rush hour. A typical 50km GTA commuter would pay $2.50 each way. Less than a large coffee, but it would generate massive revenue for repairs and expansion.

The Snowbird Question

Think about the snowbirds who spend November through March in Palm Springs. They pay zero Canadian income tax while abroad, but when their passport gets stolen at a casino, guess who they call? The Vancouver consulate.

About 2.8 million Canadians live overseas [9], many paying little or no Canadian tax. A modest $250 annual "citizenship services fee" seems reasonable, especially since Americans already tax global income [10].

If you can afford that Palm Springs condo, you can afford to chip in for embassy services.

A Simple Menu (With Real Numbers)

Instead of the current blob, imagine getting a tax bill that looks like this:

| What You're Buying | Your Share | What It Funds |

|---|---|---|

| Core Government | 15% (after basic exemption) | Defense, courts, basic services |

| Health Insurance | $100–$900 (sliding scale) | Doctors, hospitals, ambulances |

| Road Premium | Pay-per-km on express lanes | Highway maintenance, snow plows |

| Climate Action | 1% of income | Flood protection, green rebates |

| Citizenship Services | $50/adult | Elections, embassies, passports |

Every line item would be tracked in real-time by CRA. Move money between pots, and taxpayers would notice faster than Leafs fans spotting a blown lead.

Making Everyone Pay Something

Consider Jamie, a 24-year-old barista making $28,000 in Halifax. Under current rules, she pays zero federal tax but votes on spending priorities.

Under this system: $200 core + $100 health + $50 citizenship = $350 total (1.25%)

That's less than her monthly phone bill, but it makes her a stakeholder. Multiply by millions of young Canadians, and you've got both revenue and civic engagement.

The Brain Drain Reality

Meanwhile, Newfoundland's top tax rate hits 54.8% [11]. That's higher than most European social democracies. A pediatric surgeon from St. John's can make $400,000 in Boston and keep $280,000 after tax, versus $220,000 in Canada.

Canadian businesses invest only 79 cents per worker for every U.S. dollar [12]. Lower, clearer rates could bring both the money and the talent home.

The Human Bottom Line

This isn't really about tax policy. It's about fairness and incentives. Right now, we punish nurses for working overtime while letting wealthy snowbirds freeload on services.

We tell middle-class families they're "rich" while they struggle with daycare costs. We create a system where millions of voters have no financial stake in the decisions they're making.

Label every loonie. Make everyone contribute something. Keep ambition legal.

That's not just good tax policy. It's good for democracy.

What do you think? Should Canada break up the tax blob, or does the current system work fine? Share your thoughts, especially if you're currently avoiding overtime because the math doesn't work.

References:

Books:

- Buchanan, James M. The Calculus of Consent. University of Michigan Press, 1965.

- Stiglitz, Joseph E. Economics of the Public Sector. W. W. Norton & Company, 2015.

- Saez, Emmanuel. The Triumph of Injustice. W. W. Norton & Company, 2019.

Government and Institutional Sources:

- C.D. Howe Institute, 2025 Shadow Budget – mid-income workers face high marginal effective rates.

- Finance Canada, Delivering the Middle-Class Tax Cut (May 2025) – relief aimed below $114,750.

- Ontario Budget 2024, Chapter 3 – Health Premium revenue ≈ $5 B.

- Canada Revenue Agency, Selected T1 Statistics 2023 – about 5 M returns had no federal tax payable.

- Australian Tax Office – 2% Medicare levy and surcharge.

- INRIX 2024 Traffic Scorecard – London drivers’ £902 congestion cost.

- 407 International Inc., Q1 2025 results – $410 M revenue.

- Ministry of Transportation of Ontario – Highway 401 daily traffic ≈ 450K vehicles.

- Asia Pacific Foundation, Canadians Abroad study – 2.8 M Canadians overseas.

- Internal Revenue Service (U.S.), Citizens and Resident Aliens Abroad – worldwide income rule.

- PwC Canada, Tax Facts and Figures 2025 – NL top marginal rate 54.8%.

- Fraser Institute, Federal Blueprint for Prosperity 2025 – 79 ¢ capital per worker vs U.S. $1.